BIMS Receipt Simplifier and Payment Message Creater is a helping tool to Simplify Receipt of Various Accounts Transfers done through BiMS Software for Treasuries. It also helps us to create a well disciplined payment message. This will be very helpful for the Accountants in Panchayaths, Municipalities and Corporations in Kerala.

My Posts

Saturday, 28 December 2024

Wednesday, 11 December 2024

Gap Fund Proforma Simplifier 2024-25 (for ILGMS GP )

This tool helps us to calculate the Probable gap fund that may be allotted to the Grama Panchayath.. This tool coordinates data from ILGMS. We have to copy paste Income & Expenditure and Balance Sheet and Receipt & Payment Data to this tool. This will be very helpful for Accountants of Panchayaths in Kerala.

To Download

Gap Fund Proforma Simplifier 2024-25 (for ILGMS GP )

Wednesday, 12 June 2024

Depreciation Calculation Helper 2023-24 for Municipal Accounts (Saankhya)

Depreciation Calculation Helper - Video Tutorial

This is very useful for Accountants in Municipalities and Corporations in Kerala.

Depreciation Calculation Helper is a tool which helps accountants in Municipalities of Kerala to Calculate depreciation values of Assets. It incorporates Balance sheet of previous years to calculate the depreciation of each assets

To Get Latest Tools Visit Panchayath Help Desk

Depreciation Calculation Helper 2023-24 for Municipal Accounts (Saankhya)

To Download File for Excel 2007 Click Here

See Also

AFS Tools 2022-23

These tools are useful Panchayaths in Kerala for their works in connection with preparing AFS (Annual Finance Statements).

These tools are useful Panchayaths in Kerala for their works in connection with preparing AFS (Annual Finance Statements).

ACCOUNTS TOOLS

There are many tools and notes to help the accountants in Panchayaths of Kerala. These tool will be very useful for Accountants and other Section Clerks of Panchayaths and Municipalities of Kerala.

There are various tool to help accounting process viz..

Accounting Registers List Maker, Property tax Provision Calculator, AFS Tools, Depreciation Calculation Helper, Saankhya Year Beginning Process Helper, Budget Preparation Helper, DCB Statement Maker, E Bill Vouchers Modifier, DPC Own Fund Statement Maker, Arrears on Ratio Promotion to Cash Bill Maker, Financial Key Ratios Analysis Helper, TDS IT CHALAN for Salary Remittance or Work Bill Deduction (ITNS 281), Joint Venture Funds Verifier, E-Payment Bank Reconciliation Helper, BIMS Receipt Simplifier, BIMS Bank Pass Book Simplifier, Saankhya Sanchaya Data Comparison and Mapping Tools, Saankhya Bank Book Simplifier, Capital Works in Progress to Assets Calculation Helper, Accounts Verification Helper and Bill Register Maker

Monday, 13 May 2024

Depreciation Calculation Helper 2023-24 for GP (Saankhya & ILGMS Period)

Depreciation Calculation Helper - Video Tutorial

This is very useful for Accountants in Panchayaths in Kerala.

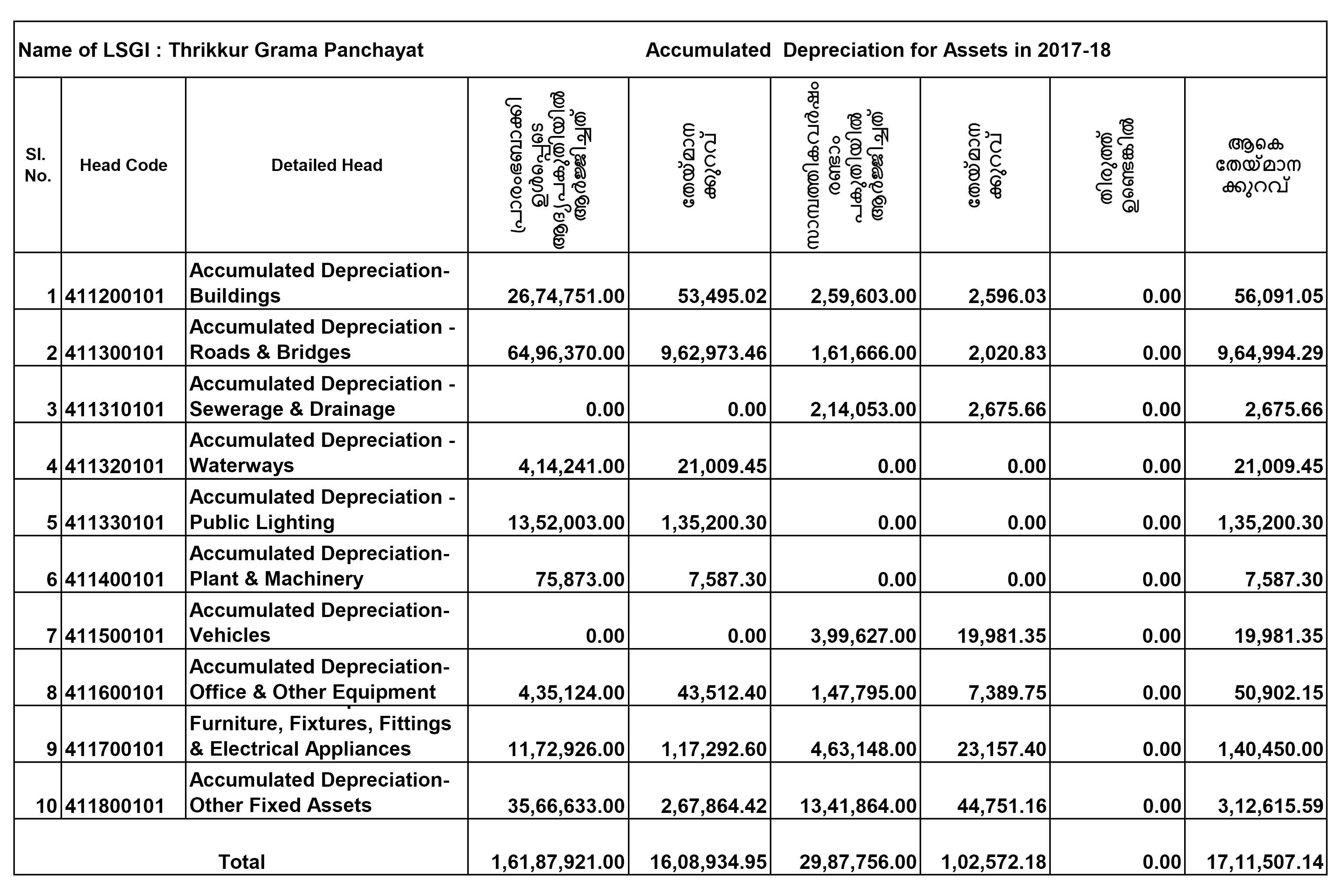

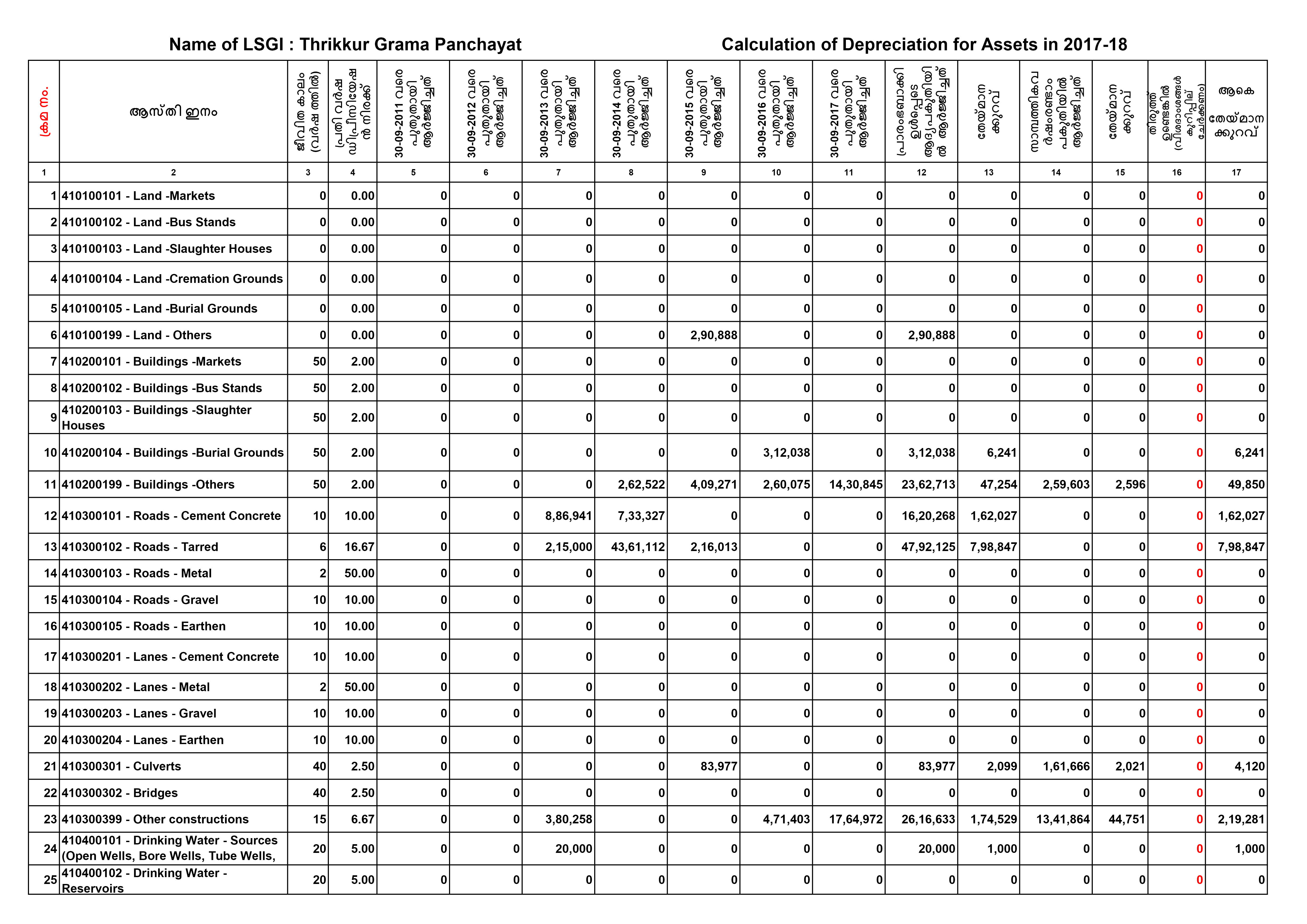

Depreciation Calculation Helper is a tool which helps accountants in Panchayath Department of Kerala to Calculate depreciation values of Assets. It incorporates Balance sheet of previous years to calculate the depreciation of each assets. This tool contains two counter parts. One for Saankhya Periiod and another for ILGMS Period. You should calculate both period to get the correct calculation for Depreciation.

To Get Latest Tools Visit Panchayath Help Desk

Depreciation Calculation Helper 2023-24 for GP (Saankhya & ILGMS Period)

To Download File for Excel 2007 Click Here

See Also

AFS Tools 2022-23

These tools are useful Panchayaths in Kerala for their works in connection with preparing AFS (Annual Finance Statements).

These tools are useful Panchayaths in Kerala for their works in connection with preparing AFS (Annual Finance Statements).

ACCOUNTS TOOLS

There are many tools and notes to help the accountants in Panchayaths of Kerala. These tool will be very useful for Accountants and other Section Clerks of Panchayaths and Municipalities of Kerala.

There are various tool to help accounting process viz..

Accounting Registers List Maker, Property tax Provision Calculator, AFS Tools, Depreciation Calculation Helper, Saankhya Year Beginning Process Helper, Budget Preparation Helper, DCB Statement Maker, E Bill Vouchers Modifier, DPC Own Fund Statement Maker, Arrears on Ratio Promotion to Cash Bill Maker, Financial Key Ratios Analysis Helper, TDS IT CHALAN for Salary Remittance or Work Bill Deduction (ITNS 281), Joint Venture Funds Verifier, E-Payment Bank Reconciliation Helper, BIMS Receipt Simplifier, BIMS Bank Pass Book Simplifier, Saankhya Sanchaya Data Comparison and Mapping Tools, Saankhya Bank Book Simplifier, Capital Works in Progress to Assets Calculation Helper, Accounts Verification Helper and Bill Register Maker

Saturday, 13 April 2024

Depreciation Calculation Helper 2023-24 (FOR Panchayath Accounts) (Saankhya) (Block & District Panchayaths)

Depreciation Calculation Helper - Video Tutorial

This is very useful for Accountants in Panchayaths in Kerala.

Depreciation Calculation Helper is a tool which helps accountants in Panchayath Department of Kerala to Calculate depreciation values of Assets. It incorporates Balance sheet of previous years to calculate the depreciation of each assets

To Download

Depreciation Calculation Helper 2023-24 (FOR Panchayath Accounts) (Saankhya) (Block & District Panchayaths)

See Also

AFS Tools 2022-23

These tools are useful Panchayaths in Kerala for their works in connection with preparing AFS (Annual Finance Statements).

These tools are useful Panchayaths in Kerala for their works in connection with preparing AFS (Annual Finance Statements).

ACCOUNTS TOOLS

There are many tools and notes to help the accountants in Panchayaths of Kerala. These tool will be very useful for Accountants and other Section Clerks of Panchayaths and Municipalities of Kerala.

There are various tool to help accounting process viz..

Accounting Registers List Maker, Property tax Provision Calculator, AFS Tools, Depreciation Calculation Helper, Saankhya Year Beginning Process Helper, Budget Preparation Helper, DCB Statement Maker, E Bill Vouchers Modifier, DPC Own Fund Statement Maker, Arrears on Ratio Promotion to Cash Bill Maker, Financial Key Ratios Analysis Helper, TDS IT CHALAN for Salary Remittance or Work Bill Deduction (ITNS 281), Joint Venture Funds Verifier, E-Payment Bank Reconciliation Helper, BIMS Receipt Simplifier, BIMS Bank Pass Book Simplifier, Saankhya Sanchaya Data Comparison and Mapping Tools, Saankhya Bank Book Simplifier, Capital Works in Progress to Assets Calculation Helper, Accounts Verification Helper and Bill Register Maker

Wednesday, 31 January 2024

Gap Fund Proforma Simplifier 2023-24 (for ILGMS GP )

This tool helps us to calculate the Probable gap fund that may be allotted to the Grama Panchayath.. This tool coordinates data from Local Saankhya. We have to copy paste Income & Expenditure and Balance Sheet Data to this tool. This will be very helpful for Accountants and Accountants of Panchayaths in Kerala.

To Download

Gap Fund Proforma Simplifier 2023-24 (for ILGMS GP )

Tuesday, 30 January 2024

Gap Fund Proforma Simplifier for MC 2023-24

This tool helps us to calculate the Probable gap fund that may be allotted to the Municipalities.. This tool coordinates data from Local Saankhya. We have to copy paste Income & Expenditure and Balance Sheet Data to this tool. This will be very helpful for Accountants and Accountants of Municipalities in Kerala.