Go to the NEW TOOL

My Posts

Thursday, 25 April 2019

Saankhya Bank Book Simplifier

Saankhya Bank Book Simplifier is a simple tool to convert Saankhya Bank Book in a user friendly version. It can be easily taken print out. And we can search items using Auto Filter. This tool will be very helpful for the accountants of Panchayats in Kerala.

Monday, 15 April 2019

E-Payment Bank Statement Maker

E-Payment Bank Statement Maker

E-Payment Bank Statement Maker is an easy tool developed by Panchayath Help Desk for the calculation of Property Tax paid On Line. This tool is very helpful for Accountants and Property Tax Section Clerks of Panchayats in Kerala.

See Also

E-Payment Bank Reconciliation Helper

E-Payment Bank Reconciliation Helper is an easy tool developed by Panchayath Help Desk for the calculation of Property Tax paid On Line. This tool is very helpful for Accountants and Property Tax Section Clerks of Panchayats in Kerala. This provides the amount to be receipted datewise or monthwise.

Thursday, 11 April 2019

Plan Expenditure Verifier

Plan Expenditure Verifier is a simple tool which is very useful for the Accountants and Plan Clerks of Panchayats in Kerala.

By the help of this tool they can easily find out the differences in Plan Fund expenditure in the soft wares like Local Saankhya, Web Saankya and Sulekha.

This tool is very helpful while preparing Annual Financial Statements.

To Get the tool

By the help of this tool they can easily find out the differences in Plan Fund expenditure in the soft wares like Local Saankhya, Web Saankya and Sulekha.

This tool is very helpful while preparing Annual Financial Statements.

To Get the tool

Plan Expenditure Verifier

Click Here

Monday, 8 April 2019

Saankhya Ledger with Wardwise and Headwise Report to Register

Saankhya Ledger with Wardwise and Headwise Report to Register is an easy tool to convert Ledger Reports of any Head powered with Headwise Reports. This process is very useful for section clerks and accountants in Panchyaths of Kerala. Heads like Licence, Profession Tax etc. can easily be converted into Registers

To Download the Tool

Saankhya Ledger with Wardwise and Headwise Report to Register

Click Here

See Also

AFS Tools 2020-21

These tools are useful Panchayaths in Kerala for their works in connection with preparing AFS (Annual Finance Statements).

ACCOUNTS TOOLS

There are many tools and notes to help the accountants in Panchayaths of Kerala. These tool will be very useful for Accountants and other Section Clerks of Panchayaths and Municipalities of Kerala.

There are various tool to help accounting process viz..

Accounting Registers List Maker, Property tax Provision Calculator, AFS Tools, Depreciation Calculation Helper, Saankhya Year Beginning Process Helper, Budget Preparation Helper, DCB Statement Maker, E Bill Vouchers Modifier, DPC Own Fund Statement Maker, Arrears on Ratio Promotion to Cash Bill Maker, Financial Key Ratios Analysis Helper, TDS IT CHALAN for Salary Remittance or Work Bill Deduction (ITNS 281), Joint Venture Funds Verifier, E-Payment Bank Reconciliation Helper, BIMS Receipt Simplifier, BIMS Bank Pass Book Simplifier, Saankhya Sanchaya Data Comparison and Mapping Tools, Saankhya Bank Book Simplifier, Capital Works in Progress to Assets Calculation Helper, Accounts Verification Helper and Bill Register Maker

Sunday, 7 April 2019

Capital Works in Progress to Assets Calculation Helper

This tool will help us to convert Capital Works in Progress to Various Assets. This will be very helpful for the Accountants in various Panchayats in Kerala. Every Year Panchayats are creating several types of assets viz. Roads, Buildings, ...... But when the bill is prepared, if we are allotting the part bill only, then the expenditure will be recorded as Capital Work in Progress. This should be converted into respective assets on the completion of works. However, we issue the final bills as the Correct asset expenditure. But still the part bill voucher remains as Capital Work in Progress.

In this circumstances at the year ending we should check the ledger of Capital Work in Progress and find whether the work is done in complete or not.

If the work is completed in the current year itself we should change the payment voucher through adjustment journal. By this journals, we can see in future that the voucher itself adjusted to the corresponding asset heads.

But if the works are completed after the bill year then we can do only a rectification journal and in that case we take the total amounts of each assets to convert from Capital Work in Progress.

To DownLoad the tool

In this circumstances at the year ending we should check the ledger of Capital Work in Progress and find whether the work is done in complete or not.

If the work is completed in the current year itself we should change the payment voucher through adjustment journal. By this journals, we can see in future that the voucher itself adjusted to the corresponding asset heads.

But if the works are completed after the bill year then we can do only a rectification journal and in that case we take the total amounts of each assets to convert from Capital Work in Progress.

To DownLoad the tool

Capital Works in Progress to Assets Calculation Helper

Click Here

Wednesday, 3 April 2019

Saankhya Headwise Report to Register

Saankhya Headwise Report to Register is an easy tool to convert Headwise Reports of any Head into Registers. This process is very useful for section clerks and accountants in Panchyaths of Kerala. Heads like Licence, Profession Tax etc. can easily be converted into Registers. It's very useful to prepare registers and check the correctness when we are busy to prepare AFS

Click Here

To Download the tool

Saankhya Headwise Report to RegisterClick Here

Monday, 1 April 2019

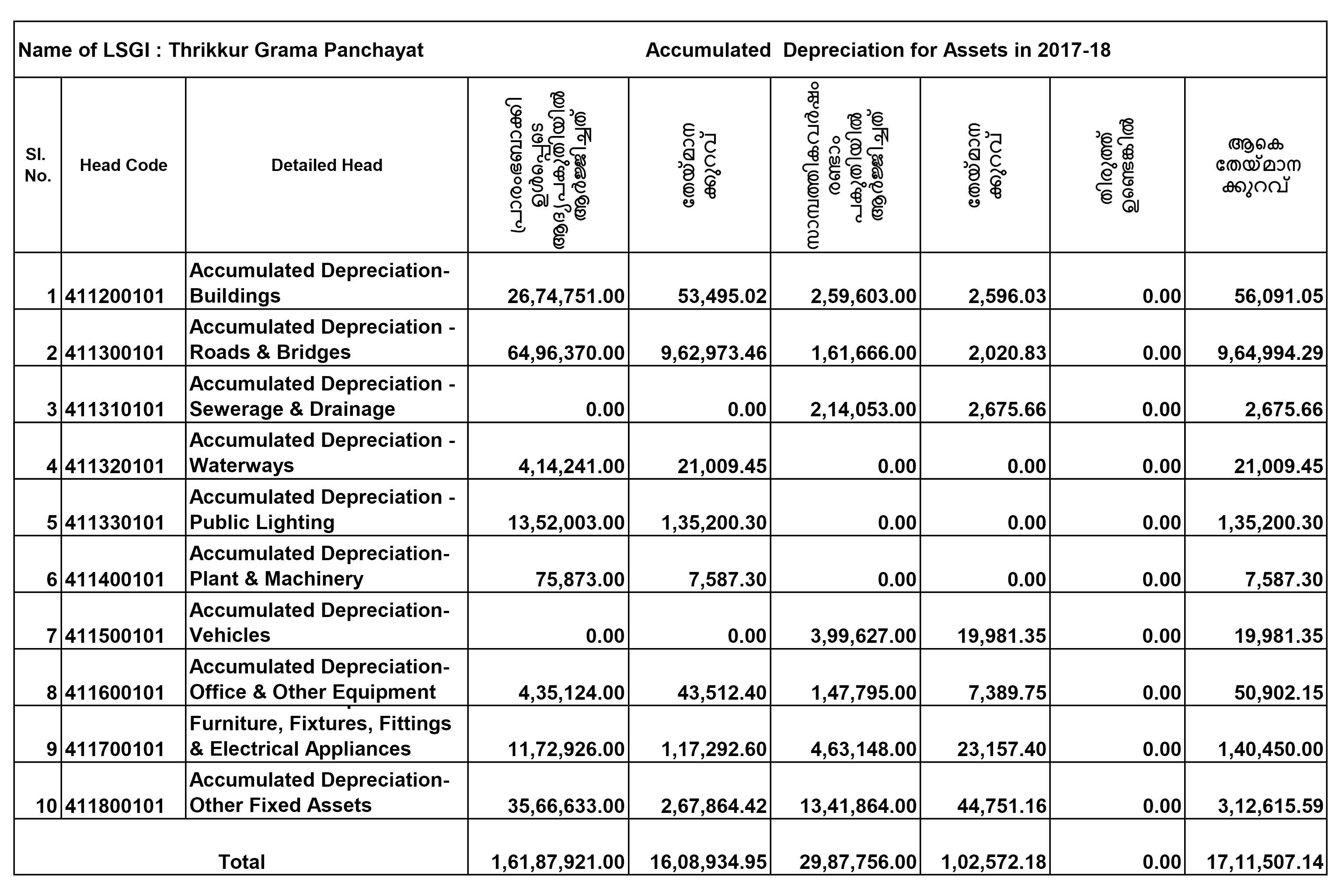

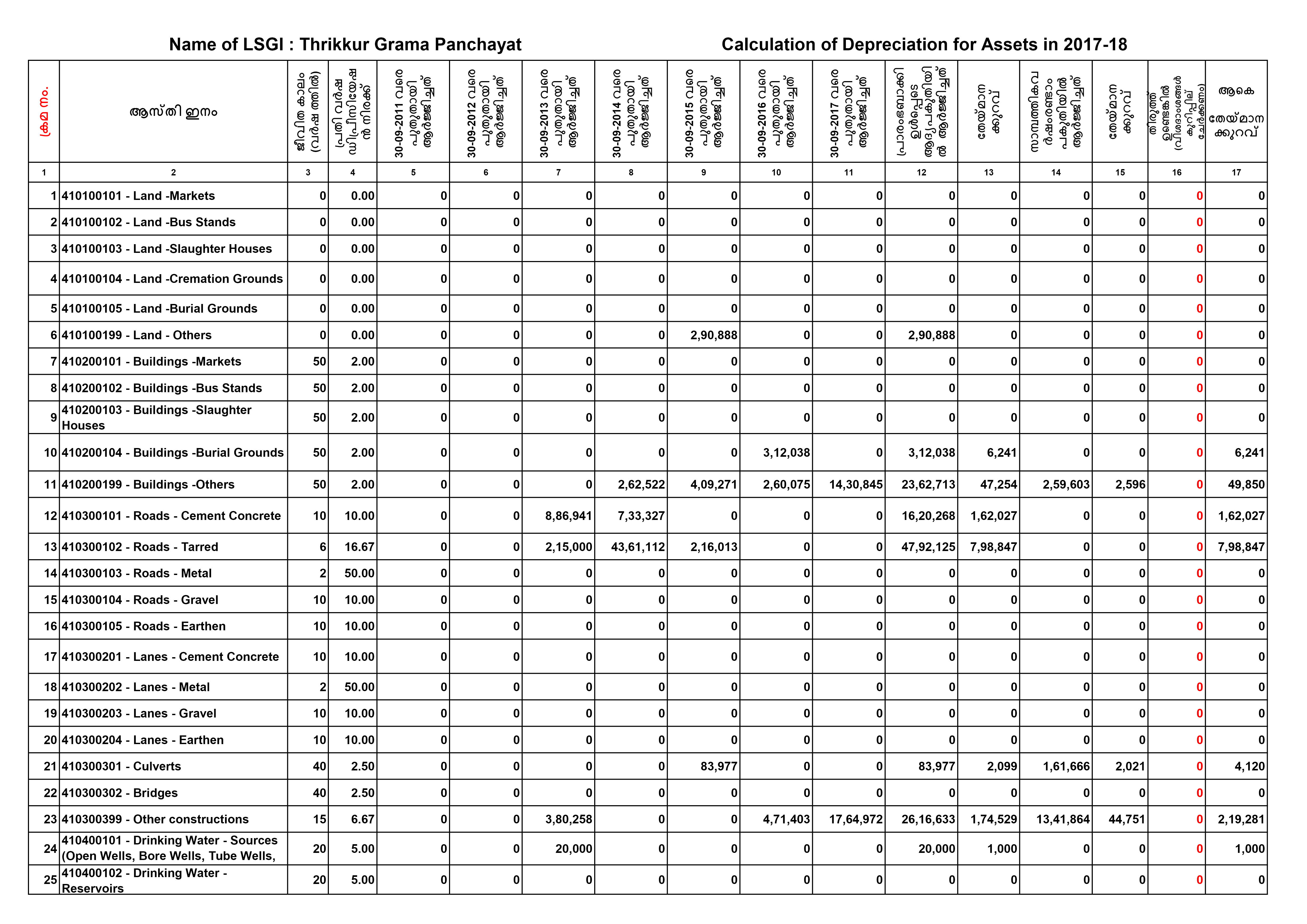

Depreciation Calculation Helper 2018-19

Depreciation Calculation Helper is a tool which helps accountants in Panchayath Department of Kerala to Calculate depreciation values of Assets. It incorporates Balance sheet of previous years to calculate the depreciation of each assets

To Get Latest Tools Visit Panchayath Help Desk

To Download File for Excel 2007 Click Here

Subscribe to:

Comments (Atom)